Far too often I see business owners left scratching their heads wondering why no one is showing any interest in their business for sale. In their eyes their business is simply perfect! “Who wouldn’t want to own it”, they say to themselves.

Most business owners are far too emotionally attached and can only see their business through rose coloured glasses. They think because they have invested $1,000,000 into the business over 10 years, then it must be worth a minimum of $1,000,000.

The reality is a businesses true value is all about the cash flow, then you can add the assets on top of that.

This comes as a surprise to most business owners when they get a professional valuation, at which point they realise they may have over capitalised.

Should a Broker Value My Business

Business Brokers have also been known to lead the business owner astray with an inflated valuation. They know what the owner wants to hear and doing this will almost certainly secure the broker the listing. Then once they have signed on the dotted line, they will advice them to lower the price, bit by bit over time. This isn’t always the case, but it is certainly something to be aware of.

Undervaluing your business is another costly error for obvious reason. You might think the asking price you came up with is fair, but doing your due diligence might prove otherwise.

Both over valuing and under valuing a business will lead you down a path of disappointment.

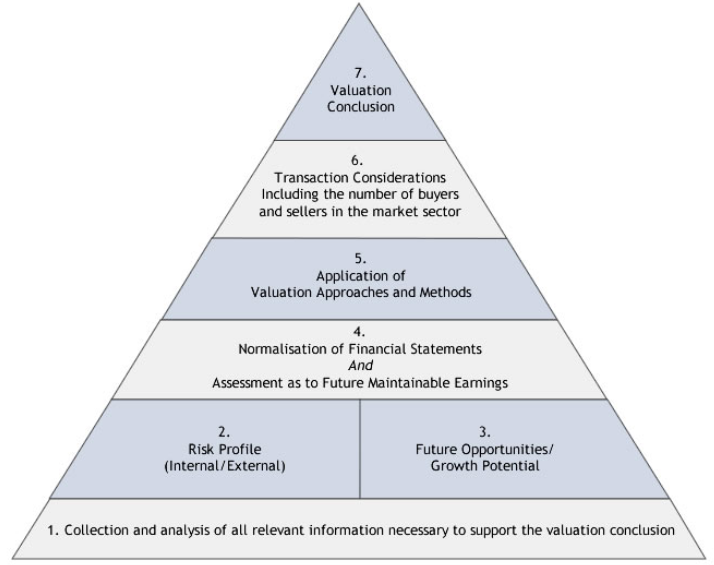

Valuation Process

The valuation of a business begins with research. Investigate into the best technique for determining the value of a business, which may lead you to an independent assessor or even your accountant.

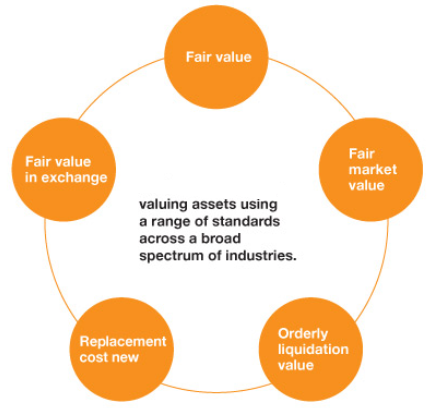

Cross-reference by using several methods of comparison for assessment of total value of a business may be the right solution for accurate valuation of assets.

Comparable sales, asset valuation, income valuation in capitalised future earnings and earnings multiple calculation, as well as industry standards are used by assessors in valuation of a business.

Let me explain in more details about each of these points:

Comparable Sales

Comparables use the competitor as model in calculation of valuation. Comparable sales valuation methods are standard. Recent sales of similar companies offer the initial index for valuation of like businesses.

Asset Valuation

The asset-based approach is the total sum of all assets. Both tangible assets (i.e. property and real property) and intangible assets (i.e. proprietary data, copyrights and trademarks) are assessed for replacement value.

The definition of property and real property includes plant, property and equipment (PPE) used in capitalisation, as well as real estate investment part of a business portfolio. Subtraction of liabilities from the value of assets is the baseline asset valuation of a business.

This method does not account for future revenues that might be generated in the future.

The standard to initiation of valuation of operation financials, the total of cash, stock, PPE and receivables. Liabilities in the form of bank debts and payments due are the sum of value subtracted from the assets of the business to arrive at the net asset value (NAV).

If accounts receivables have been paid for by an investor in the short-term in exchange for liquidity, and that arrangement is on a limited contract stipulating future return of those accounts upon payment of interest and fees, those assets must be accounted for as assets.

Example – Max wants to buy a restaurant business that has assets of $500,000 and liabilities of $300,000. The net asset valuation of the business is $200,000.

Income Valuation

This model of valuation calculates current and/or future revenues. If an investor is considering more than one business of similar class, the return on investment is the focus in measure of competitive performance. Capitalised future earnings, and earnings multiple speculation.

Capitalised future earnings measures the value of assets if sold, and also rights to profits. Commonly used for valuation of small businesses, capitalising future earnings analyses rate of return on investment (ROI). Calculation of capitalised future earnings addresses the average net profit of a business during the past 3 years. Profit and loss statements are used to adjust one-off expense or irregular line items found in annual financial reporting.

Annual rate of return is measured according to investor projection, for evaluation of risk. The higher the risk the greater the returns, yet also the potential for loss. Businesses invested in safe-haven assets such as fabricated precious metals, will have lower risk and also less potential for exposure. In the latter case, the absence of speculation would translate into lower returns. To attain capitalised future earnings, divide net profits by the rate of return, and multiply the total by 100. This gives the value of future return on investment.

Earnings multiple includes assessment of the value of shares traded on a stock exchange, and unlisted businesses. Either is a risk scenario, with potential for high earnings. Profits from speculation resulting in market exposure, or hidden value mean that exponential returns may be the pay-off a business if acquired by an investor. Earnings before interest and tax (EBIT) is used to compute earnings multiple valuation. If a business is valued at two to three times its annual revenues, the earnings multiple scenario is present.

Industry Formulas

Sector formulas applied to businesses part of targeted industries, may result in the use of distinct formulas and customary rules of calculation to arrive at valuation of a business. Companies faced with higher rates of risk exposure, and far higher rates of return on investment, such as natural energy resource conversion businesses, are likely to use complex formulas to arrive at value.

Future Earnings

Inclusive in the sale of your business are all assets and the rights to future income the business will generate.

Inclusive in the sale of your business are all assets and the rights to future income the business will generate.

One of the more popular techniques to value a small business is capitalised future earning, which focuses on the ROI (return on investment) the potential buyer can expect.

Example – Max is considering purchasing an existing online business with average profits if $250,000 pa. Max needs a yearly return of 25% ($62,500) to make this an interesting investment for him.

Where to Now

If you are interested in finding out more about valuation of a business that requires a professional assessment, contact your accountant or independent valuer for a consultation and reporting on assets for purposes of insurance, tender or investor acquisition.

We recommend the following sites for further information:

Here is a great explaination valuing a business using multiples as we touched on earlier.

When Should I sell My Business?

Now that you know how to determine the value of your business, the next question is, why am I selling?

There are many reason a business owner might decide to sell their business and if they time it correctly, it will be a huge advantage. This is not always possible though, depending on the reason they are selling.

Here is a great reference about timing the sale of your business: Business sale: getting the timing right.

Below we have listed 7 top reasons business owners decide to sell:

1) Your Business is Performing at its Peak

Once your business starts to perform at a level where it is clearly obvious business is booming, it might be time to cash out. Selling a business during this period is the optimal time, as it will draw the most attention from potential buyers.

They like to see high profits and sales figures, especially if there has been some significant growth over the past 1-3 years.

If your sales and profits are high, obviously your asking price will be a high figure as well. Usually between 1.5 and 3 times annual profits (plus assets, stock, etc).

Get your accountant to go over your financials to determine if your sales/income have peaked in recent times and if they have and you are interested in selling your business, the timing couldn’t be better.

2) Low Interest Rates

In recent times, experts have predicted that interest rates could soon be on the incline and 2014 may be the year for this to happen.

Most business buyers will need finance when acquiring a business and with interest rates very low and affordable, it makes for a great time to sell a business.

The higher the interest rates, the less likely an investor will be to pay a premium price for a business. Business valuations will fluctuate based on interest rates. Below is a great tool to compare current interest rates:

3) Retirement

Whether you are a business owner or an employee, there will come a time in your life where you will make the decision to retire.

As a business owner, you need to make sure you have properly planned for the future of the business by training your staff in all areas of running your business in the event you are absent, which includes your retirement.

Having staff with this expertise is a major asset when selling as it makes for a smooth transition when the new owner comes on board.

Avoiding a negative impact on the day to day running of the business as new management is settling in will insure it is business as usual.

4) Poor Performance

Unfortunately business owners are sometimes forced into selling their businesses do to under performing.

Thanks to the power of the internet, online entrepreneurs are creating a very competitive market place across almost all industries and it isn’t uncommon for small business owners to sell up or close their doors as a result.

Some other reasons might be:

- Poor management;

- Poor marketing;

- Location;

- Funding;

- No online presence (website).

The good news is that there is a huge market for under performing businesses.

Online entrepreneurs like to buy up these type of failing businesses for a good price, give them a business make over, increase profits and revenue and then flip for a profit. Something similar to what home renovators do. It’s big business.

5) Financial Security

Financial security is another popular reason business owners like to sell. Sometimes this is prompted by a competitor or a potential buyer who basically knocks on your door and displays their interest.

This will put the business owner in the ‘box seat’, allowing them to ask for a higher price based on the buyers interest in this acquisition, even though the business is not for sale.

Another reason a business owner might cash out purely for financial gain is when the business has reached a certain value in the market place. It is not uncommon for business owners to sell purely for the profit, setting them up financially for the future.

From an entrepreneurial point of view, selling a business for a profit once it reaches a certain value and moving onto the next project is also a regular occurrence.

Of coarse there will be taxes involved which your accountant will take care of.

Once again, timing plays an important part of this outcome if you want to fetch the highest price possible.

6) Poor Health

Regardless of a businesses current performance, owners are sometimes forced into retirement due to ill health. I’m sure this is not the way they wanted to exit the workforce, and depending on the time frame they need to sell (usually fast), this puts the buyer in a strong negotiating position.

Selling a business due to poor health is very common and something buyers need to be aware of when hunting for a good business at a great price.

7) Achieved Your Business Plan Goals

Whether you bought an already existing business or you started one from scratch, you most like had a long ( or short) term business goal. Smart business owners will set out to achieve these goals which are usually in a progression with an end goal in site, which could be 2, 5 or a 10 year time line.

Once each goal set has been achieved, the owner will now have the decision to sell up as outlined in the business plan and leave on their own terms.

Knowing how to value your business can be the difference between fetching the maximum sale price and in some cases not selling the business at all. Get this right and you can expect a smooth selling process.